top of page

The Playmaker in Action: Stocks Flashing Reversal Signals

Using the Playmaker risk-assessment model, here are the stocks flashing potential sentiment reversal signals.

Joshua Enomoto

Jul 6, 20251 min read

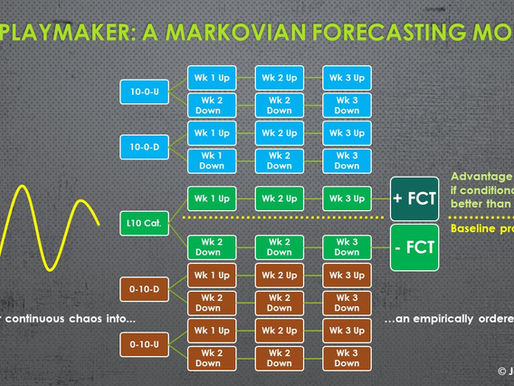

Turning Market Chaos into Probabilistic Clarity: The Playmaker Model

Tired of chasing market randomness disguised as analysis? Playmaker converts chaotic price action into structured probabilities you can actually use.

Joshua Enomoto

Jul 5, 20252 min read

Sentiment Reversal: Using the Playmaker to Uncover Highly Probabilistic Ideas

Although these stocks have encountered negative momentum, a sentiment reversal could statistically be on the cards.

Joshua Enomoto

Jun 23, 20252 min read

Shifting the Odds: This Week's Probabilistically Compelling Ideas

Using the Playmaker's advanced probability engine, here are this week's statistically favorable ideas.

Joshua Enomoto

Jun 16, 20254 min read

The Playmaker: Identifying High-Probability Ideas for Data-Driven Traders

When trading, you have limited resources. It's time to focus those resources on the ideas that offer a higher-than-average probability of success.

Joshua Enomoto

Jun 8, 20253 min read

The Probability Gambit: Lessons from Stochastic vs. Dynamic Projections

Dynamic projections reveal the market’s fear-greed shifts, offering a sharper edge over traditional, linear stochastic models.

Joshua Enomoto

Jan 11, 20252 min read

Post-Election Drama: Is the Market Overpricing Volatility?

Discover how DJT's 250% implied volatility post-election could present opportunities for credit-based options strategies in this video!

Joshua Enomoto

Sep 29, 20241 min read

FDX Stock: Use a Bull Call Spread to Grab a ‘Bennie’ by Next Weekend

Snag a quick $100 with a smart bull call spread on FDX stock—your weekend windfall is just a price tick away!

Joshua Enomoto

Sep 25, 20244 min read

Why the Options Stack is the Future of Options Trading Education

The Options Stack uses intuitive, color-coded visuals and analogies to make complex options strategies easier for beginners to understand.

Joshua Enomoto

Sep 22, 20245 min read

APP Stock: Kicking a Field Goal with a Bull Call Spread

A bull call spread on AppLovin offers a smart, low-risk way to capitalize on its strong earnings—like kicking a field goal for steady gains.

Joshua Enomoto

Sep 16, 20243 min read

Navigating Market Volatility with a Short Call Condor on the SPY ETF

Even if the SPY ETF moves sideways this week, you can profit. Here's a quick look at a short iron condor strategy.

Joshua Enomoto

Sep 8, 20243 min read

bottom of page